The most successful companies excel in either cost leadership, like Ryanair, product differentiation, like Color Line, or focus on just the one thing they’re best at, like Pharos, which concentrates on B2B distribution technology without acting as a travel intermediary. This focus has proven successful in countering five elemental competitive forces: The threat of new market entrants, industry rivalry, the threat of substitutes (low-cost air plus rental car is always a valid substitute to ferry), and the bargaining power of customers and suppliers.

Every industry, including the ferry industry, is subject to global competition. For example, a Chinese company could buy a small regional European ferry operator, provide it with brand-new, Chinese-built vessels, and pursue a pan-European strategy. For this reason, foresightful management positions its own sales to reach global customers as well.

Ferry operators segment by product and either sell those of their routes with global appeal to travellers around the world, for example, routes connecting two exciting European capital cities or they segment by market, when, for example, a ferry operator serving a network limited to the Aegean or the Northern Baltic region sells all of their services to British, French or German travellers as well. In both cases, ferry operators must reach the travellers in the target markets, which is usually far beyond the reach of any ferry operator’s website.

Successful travel companies, including ferry operators, understand that their offering is on the long tail side of any travel portfolio. Accommodation in a city hotel or an intra-European point-to-point flight sells even to the same travellers several times a year. A ferry crossing or mini-cruise sells to most people only once per year – but to a much larger number of people, provided they’ve been made aware of this option by their travel agent or OTA. The potential total number of accommodation or air sales (referred to as the short tail of the diagram) equals the possible total number of ferry sales (referred to as the long tail).

The essence of distribution is to ensure that potential travellers worldwide can easily find and book a ferry operator’s European services, regardless of where they are searching for travel information and reservations. Customers will only make a purchase if the right product is available through the right channel.

To date, B2C direct sales through a ferry operator’s own website still is a popular channel, but the limitations in reach are becoming more and more visible. The first ferry operators, therefore, have started to treat the three channels (1) directly to the consumer, (2) through a retailer network, especially in remote but vast and lucrative markets like China or North America and (3) through a Value-Added-Reseller like Pharos’s distribution partners who can sell ferry in conjunction with accommodation or other travel modules as a package. In this case, the actual price of the ferry ticket can even be opaque. Distribution channels two and three can be – but don’t necessarily have to be – online sales channels.

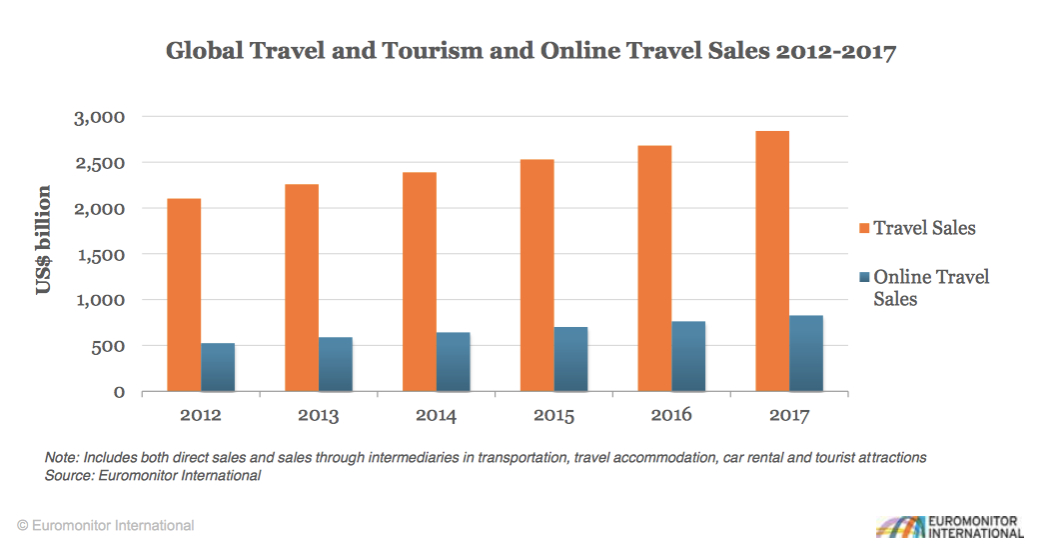

The global online travel sales market is worth $800 billion. This is only a fraction of the total global travel sales market of $2.700 billion. Ferry operators that only sell via their own online channels accept that they have to spend much money for excellent web design, conversion strategies and search engine optimisation – and while Google is the leading search engine in Europe, to reach Chinese and North American travellers, this effort needs to be replicated over other search engines as well. And despite all those efforts, the maximum they will ever reach is 25% of the total travel market – in China, only 13% even consider websites for travel booking.

To maximise one’s reach to grow sales volumes, ferry operators in 2017 need to be available and sellable on B2B desktops like travel agency distribution systems; on B2C desktops, that’s the travellers’ computer where they can find the ferry offering both through the search engine as well as on his preferred travel websites (e.g. Expedia, or Lastminute), on mobile devices, where websites solemnly made for desktop computers don’t convert and through personal voice assistants.

“Siri, how do I get to Sweden?” – “Echo, are there any short cruises in the Baltics?” – When the iPad was first introduced, the media and most people said hardly anybody would ever use it. So don’t make a mistake now; don’t underestimate the enormous potential of personal voice assistants. People can ask Amazon’s Echo, “How can I take my camper van to Greece?”. For the instant response, Echo is not going to leave the Amazon empire, and it is not going to ask for Alphabet’s Google search engine. Only those who sell through the Amazon ecosystem will be considered in the future. And this future has started now.

To tackle this future, this very near future, (1) focus on customers and use the right channels to reach each customer group. (2) Win in the ear of big data, just like Expedia is now doing with the Expedia+ loyalty scheme. (3) Unlock the power of partnerships; use partners to worry about your sales to Japanese and Chinese business travellers and gamblers. And (4) master the entire customer experience. Just a sales website isn’t going to do it.

3 Facts you need to know to grow ferry sales in 2017

1) Your own website can only reach 25% of your potential market

2) Selling through agents is less expensive than optimising a website for all the search engines in Europe and worldwide. Keep in mind that the Greek book on their mobile and the Chinese book via WeChat. Let agents and value-added resellers bring you global customers.

3) Closed ecosystems like Siri, Echo and others are rising. To not lose customers, enter those ecosystems